Embarking on the journey of purchasing your first home is both exhilarating and daunting. The dream of homeownership brings with it a maze of financial decisions, paperwork, and planning that can overwhelm even the savviest of buyers. To help you navigate through this process smoothly and to save money on your first home purchase, let’s delve into some common mistakes made by first-time homebuyers and explore practical advice on how to avoid them.

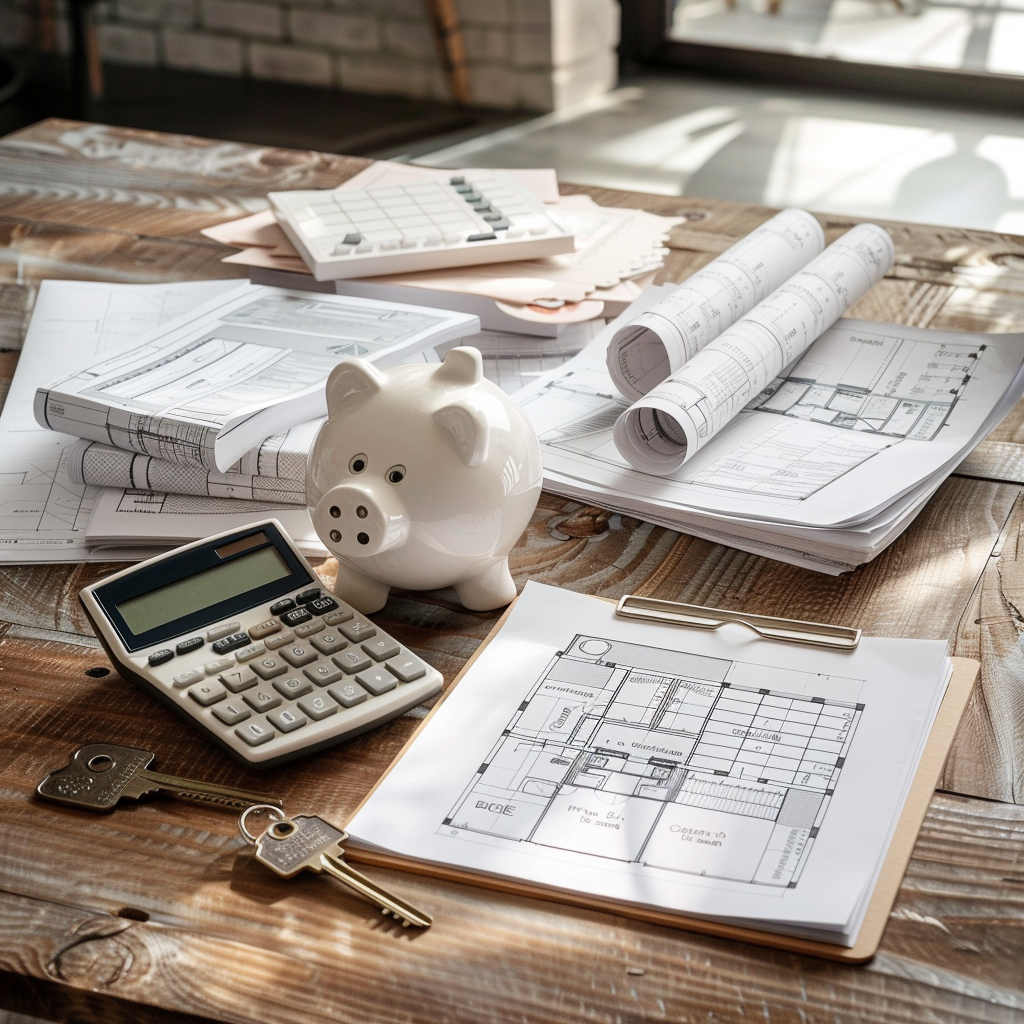

One of the initial hurdles first-time buyers face is understanding the financial aspects of purchasing a home. Speaking with a lender or loan officer to get pre-qualified is a crucial first step. This process helps buyers understand the mortgage amount they qualify for, the down payment required, and the monthly payments they would need to make. Knowing these figures early on helps in setting a realistic budget and prevents the heartbreak of falling in love with a home that’s out of reach financially. It’s about establishing a clear financial framework within which to begin your home search.

Beyond the mortgage and down payment, there are numerous hidden costs associated with buying a home that can catch first-time buyers off guard. These include loan fees, escrow charges, title insurance, inspection fees, potential repair costs, and other miscellaneous expenses that can add up quickly. Engaging in a detailed conversation with your lender to get an estimate of all potential costs involved in the transaction is vital. This thorough financial planning ensures that buyers are not blindsided by unexpected expenses, making the path to homeownership smoother and more predictable.

Another aspect of financial preparation is planning for the down payment and saving for closing costs. These expenses can represent a significant portion of the upfront costs in the home buying process. Having a savings plan specifically for these expenses can alleviate financial stress and provide a solid foundation as buyers embark on their home buying journey. It’s not just about saving up; it’s about strategically preparing for the financial requirements of purchasing a home, ensuring buyers are ready when the right opportunity presents itself.

Lastly, seeking professional advice can be a game-changer for first-time homebuyers. Real estate professionals and lenders are invaluable resources who can offer insights into market trends, home values, and the intricacies of the home buying process. Their expertise can help buyers avoid common pitfalls, such as overspending or overlooking key details in the contract. By leveraging the knowledge of these professionals, buyers can make informed decisions that align with their financial goals and real estate aspirations.

In conclusion, the road to homeownership is strewn with potential missteps, but with the right preparation and guidance, first-time homebuyers can navigate this landscape successfully. Understanding and planning for both the visible and hidden costs, saving diligently for upfront expenses, and seeking the advice of experienced professionals are all critical steps in avoiding common blunders. These strategies not only make the home buying process less intimidating but also pave the way for a more enjoyable and financially sound home purchasing experience.